Are Diamonds a Good Investment?

Yes. Over the long term, diamonds are a brilliant prospect and now is the time to buy… Let’s consider the prevailing state of diamond mining, synthetic diamond production, alternative investments and the undervaluation of gem diamonds due to purchasing behaviour.

ENDURING ALLURE OF DIAMONDS

Diamonds pack a lot of value in a tiny volume, they are easy to carry, store and hide, they last forever and have an enduring place among human desire and display. But they are also illiquid and subjectively valued without a transparent pricing index.

WHAT’S SO SPECIAL ABOUT DIAMONDS, ANYWAY?

Starting at basics, what makes diamonds so special in the first place? Their primary value to humankind has always been their extremely durable quality as tools for grinding and drilling. Why is this? After all, diamonds are the crystal form of one of the most abundant elements on Earth - carbon. But what happens to those carbon atoms is what makes the difference between a diamond tip tool and graphite in a lead pencil. Diamonds form when carbon molecules are compressed under extreme pressure and heat. Think of placing your foot onto a 1200°C hot plate and then loading a girder the length of the entire Empire State Building on top. That’s the sort of heat and pressure which might turn your foot into a diamond and which exist in nature’s furnace 100km under Earth’s surface. However, only due to violent rare tectonic events long ago, and in specific geological locations, were diamonds brought up to Earth’s surface, in reach of where they can be mined (‘extracted’). About 80% of extracted diamonds are used in industry, where, because of their hardness, they are used to cut, grind, or drill other materials. In these uses ultimately the diamonds get ground away to dust and must be replaced. This need to replenish the diamond tipped tools in industry is what has driven global extraction, not the desire to acquire beautiful gems.

GEMS FUND ALL DIAMOND MINING

The Pareto principle applies to diamond mining, proving that it’s the gems that essentially fund extraction of non-gem diamond grades: 20% of global mined diamonds account for 80% of the value. Of all the diamonds mined, only a tiny proportion are top gem quality – free of inclusions and untinted colour - and larger than 1 carat, becoming exponentially rarer in larger sizes. One carat (ct) is 200mg – the average weight of a raindrop. Every year, only 1 in 10,000 rough stones (0.01%) weighs over 1ct and remember that a diamond looses 55% of its weight in cutting. However, unlike other commodities, diamonds are not valued by weight alone but by more subjective indicators of quality: colour, clarity, and cut grades. 1

THE 4 DIAMOND MARKETS

Apart from industrial, diamonds fall into 3 other markets categories: commercial white diamonds, larger investment diamonds and fancy coloured diamonds.

Commercial white goods accounts for almost all gem diamond production. It feeds the $230 bn global jewellery industry, half of which is consumed by US purchasers - the largest jewellery market in the world, with China a close second at $95bn. Both US and Chinese markets are led by the engagement and bridal category, using small melee stones of 0.01ct to 1ct typically set in engagement rings priced from $500-$5,000 at retail.

Investment diamonds are a tiny fraction of the rest of white gem production, and are stones which are too valuable or big for ‘normal’ commercial use, being outside the typical consumer budget. A diamond would be considered large but not difficult to wear for the luxury consumer at the 3-5ct weight, with 10-20ct at the top end of the this, and 20ct+ super-gem diamonds reserved for the very elite consumer market.

The fourth market is niche and highly specialist: the world of fancy coloured diamonds.

IT'S NOT JUST SIZE THAT COUNTS

Generally, the larger a diamond and the greater clarity and pure whiteness it has, then the more it is sought after for fashioning into high class jewellery – up to a point. The best return on investment is to cut a large piece of rough into two or more commercially sized easily sellable stones, avoiding flaws and making the most of their inherent quality, rather than leave it as one big gem. So how big is big?

Large diamonds (20ct and up) fashioned into single polished gems become difficult to sell, due to their extreme size and the scarcity of people who like to wear sparklers that big, and the price per carat levels out around 50ct weight, if all else is equal regarding quality. A little footnote in history proves this point: weighing an astounding 3,106ct, the original Cullinan diamond was so big that its intrinsic value became a liability and it could not be sold despite its astonishing rarity, so the Transvaal Government decided to give it to the one person on the planet at the time for whom securing an article of such value would not be a problem and whose rank utilized such ostentation - the previous British ruler of the colony, The King Emperor George V.

OUT OF THE BLUE

The most sought-after diamonds are those that possess not only good size and clarity, but fancy colours like intensely vivid and beautiful red, yellow, pink, orange and blue. These beauties are the rarest of all in sizes over 1-1.5ct and in matched pairs or sets for jewellery. Their collectability isn’t due to passionate collectors. Over the last 20 years, the expanding global elite of wealthy investors have needed to hedge their fortunes against inflation, political and market turbulence, currency risk and low interest returns. Fancy coloured diamonds have proven to be an excellent investment as more global wealth creates demand and their supply is so limited: coloured diamonds account for only 0.01% of all gem graded diamonds mined annually.

Over the last 10 years, prices for coloured diamonds have risen on average up to 12% annually against flat white diamond prices. As an asset class they are an excellent store of value due to their re-saleability, small size and transportability. Public auction sales results published by Sotheby’s & Christies lend a degree of transparency to the pricing structures, such as they are. Vivid yellow diamonds are the least expensive per carat compared to other colours and are found in larger sizes, but red is by far the smallest crystal diamond to form in nature, and therefore highly rare and costly - easily c.$2m per carat for a vivid red stone weighing 1ct, incrementally more with every tenth decimal point of a carat in weight. Whilst a couple of formalised specialist investment funds have been created in the last decade for lower entry investments of $1m, this is an area of investment to be cautious about entering unless your portfolio is large and you seek broad diversification in asset types. It is also one that is already highly priced, so hard to see much future value.

Covid & the Russians

Global availability of diamonds depends on inventories in the value chain, and new extractions from mining. Production of rough oversupplied the market for 2 years before Covid-19 struck in 2020, and then declined during the shutdowns of the pandemic. In 2021, consumer demand rebounded after the pandemic which depleted those stockpiles and restored liquidity to diamond producers. This has led to a shortage of new rough and price increases in early 2022.

How sanctions placed on Russian diamonds by the US in March 2022 will affect prices for commercial diamonds is yet to be seen. Russia is the world’s largest producer by volume of diamonds (28% of global production, totalling 32.4m carats in 2021, with sales over $4 billion. The Russian miner Alrosa accounts for 90% of the country’s production and is 33% owned by the Kremlin. After mining, 90% of all diamonds from all over the world make their way for cutting and polishing to India, which has not sanctioned Russia. Whilst at the time of writing the US Government has only banned directly imported Russian diamonds, those which have been processed by third parties in other countries may be imported and the EU has not banned the direct import of Russian diamonds. In a display of ethical values at odds to those of their governments, major jewellery brands including Pandora, Signet and Tiffany have placed a blanket boycott on Russian diamonds no matter where or how they have been processed. But Western economic sanctions will not affect Russian diamond production or sales, as alternative methods of payment outside the SWIFT system were found by purchasers from China, ME and India to pay for Alrosa’s auctions of rough in March. 2

The increasing scarcity of natural diamonds,

However, beyond the politico-social situation, looking at what’s around the corner – or rather, what’s in the ground - reveals a sparser picture. Among existing mines, the largest and most productive primary open-pit mines have either closed or are near to closing (Argyle, Daivik, Voorspoed, Komsomolskaya & Victor mines), and no major mines are due to take their place within the next few years. There are considerable financial and logistic challenges to developing new mines. Initial exploration of sites often in remote areas or in extreme conditions, then successful prospecting, installing heavy plant and facilities in situ for mining and processing the ore, and then providing labour, security and insurance all within an ethical operational governance framework is extremely costly and continually tests existing local and national geopolitical structures. There are potential opportunities for more intensively developing non-primary alluvial locations, but these are often poorly accessible, for example in the dense rainforest of The Democratic Republic of Congo (DRC), where installing infrastructure is all but impossible. So, it is a real possibility that financially viable mines and new gem diamond supply will likely be exhausted in the future, certainly within a generation or two. 3

Mining at the rough and ready end: ‘artisanal’ mining in DRC.

Image: https://impacttransform.org/en/new-reports-on-artisanal-diamond-mining-in-cote-divoire-and-democratic-republic-of-congo/

Synthetic, laboratory-produced diamonds

The technology to manufacture synthetic diamonds was first developed in the 1950s, and a pioneering manufacturer was Element Six, a division of miner De Beers. Nowadays, after the initial investment in machinery, facilities and the ongoing cost of energy for power in manufacture, synthetic diamond production is becoming economically advantageous compared with the costs of mining. Indeed, already, 98% of industrial diamonds are synthetic: in their grown-to-order size grades, they are a viable option for producing superiority in crystal quality and durability for industrial uses.

Synthetic ‘lab-grown’ diamonds have no re-sale value so they are not considered an investment purchase, but they are accepted in the lower priced jewellery market: even De Beers’ have packaged their own synthetic production into a fashion jewellery brand called Lightbox. Increasingly, lab-grown, small sized diamonds (less than 0.10ct) are promoted for their equivalence in terms of ‘beauty’, and value compared to naturally sourced low-quality gem diamonds for fashion jewellery, and this is beginning to occur for larger sized diamonds 0.50-1ct in the bridal market. Current technology does not exist to grow much larger stones but this will improve in time, as will the cost to manufacture and usage of renewable sources to power the enormous energy required for production.

Synthetic mass production in China. image from internet search

SUPPLY AND DEMAND

However, a dwindling natural diamond supply from mining won’t matter for the industrial diamond market because a growing, increasingly competitive industry producing synthetic diamonds nicely matches the need to continually procure industrial grade diamonds whilst containing costs of production.

The dwindling natural diamond supply will not matter that much for the commercial global jewellery market, either, for reasons I’ll explain in a bit.

Where dwindling natural supply will really matter is in the availability of fancy coloured and larger gem quality diamonds, and whereas prices for fancy coloured diamonds are already massively over-the-top, investment grade white diamonds are not.

Let’s look at the white diamond market in a bit more depth.

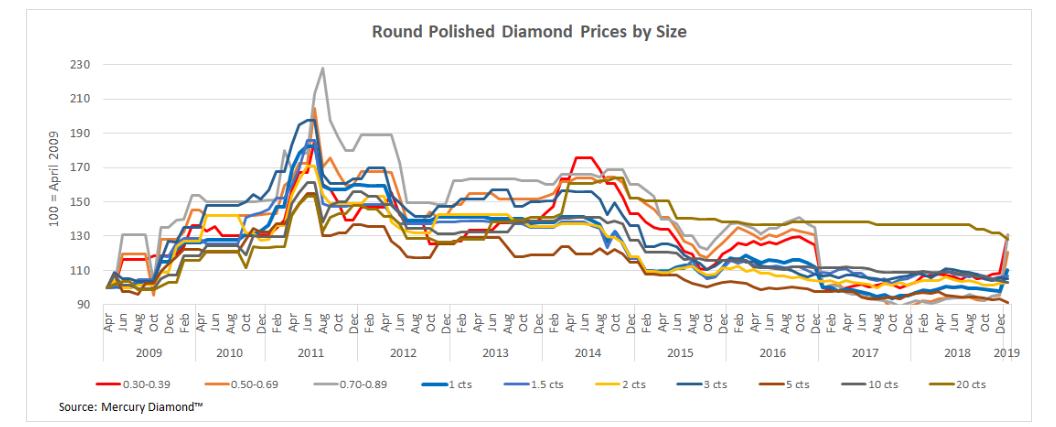

Until 2022, the trade index for 1ct diamonds, which is the most highly commercial size for jewellery sales, was flat for 5 years. Since 2021, the price of a 1ct diamond has leapt by 51% due to the rebound after the pandemic, but this will be short-lived as a cost of living squeeze and inflation dampens demand in middle class consumer markets. 4

The reasons for flat prices since 2016 include a global market slowdown, over production of rough, years of trade wars between two major markets for diamond jewellery - China and the USA - and challenges to global economies by the Covid-19 pandemic.

But one important reason may be less demand for diamonds as jewellery per se. For example, there may be now a significant break to the trend of younger adults, accumulating wealth and looking to jewellery for their ‘luxury’ status purchases. The global pandemic, supply issues and cost of living Over the same period, global value indices of luxury technology have dwarfed white diamonds’ performance. Far from aspiring to buy large gem quality diamonds, today’s Gen-Z and Millennial consumers appear to prefer more modest expenditure on luxury goods and pursue more diversity in their purchases - in technology and ‘experiences’ to define measures of success and fulfilment. An overall prevailing decline in marriage partners with a rise in positive perceptions of lab-grown diamond engagement rings: in a recent report conducted by MVI Marketing, in May 2018, over 75% of men and nearly 65% of women would consider synthetic engagement rings, a rise of 13% from the previous year. Also, even without the marketing hype of synthetic diamond producers, many consumers question the environmental impact, ethics and sustainability of diamond mining particularly where the perception is that it doesn’t directly benefit local indigenous communities and their immediate environment. Globally, the industry felt threatened, and prices have constantly softened until the rebound blip of 2021.

Current undervaluation of large white diamonds

At the super-gem end of the market, a slew of large stones mined by Gem Diamonds from their world class asset in Lesotho softened prices of hard to sell extreme sizes. It will be interesting to see the performance of The Rock, a 228ct pear shape G VS1 to be sold at Christies Geneva on 11 May 2022, valued at $30m.

The Letšeng Legacy from the Lesotho mine rich in huge diamonds. Image Gem Diamond Ltd

10 yr index - source Mercury Diamond

Where does this lead?

With the benefits of growing synthetic diamonds for industry and the decrease in global mining activity over the next generation, in my opinion we will start to see a trend to regard large natural white diamonds as desirable. After the industry felt spooked by the big hype of ‘lab-grown’ brands around 2019, no one now thinks that the natural beauty, history and increasing rarity in ‘Earth-derived’ large diamonds is seriously threatened by synthetic diamond alternatives. Dwindling mined supply, economic uncertainty, money flow sanctions, and the lack of regulation in alternative NFT and cryptocurrency markets will push demand for higher-quality investment diamonds in sizes 10ct plus. If I am correct with this, then given the current undervaluation of larger gems, diamonds are a good investment – now, whilst they are still being extracted at source. Indeed, the moment may be passing fast: the price for large gem quality diamonds of 3cts and more, slid over the 5-year period from 2016 but since 2021 has increased YOY by 35%. Even bigger diamonds of 20ct have been consistently stable for 6 yrs, trading at 30% more than the value of 3ct stones, and a 20ct diamond recently broke auction records to sell for $1.2m in Australia in Dec 2021.

Over the long term there are few assets with such a brilliant prospect. I had the resources, whilst the prices are low and no one is noticing, I would buy large white gem diamonds, around 5-10-20ct in size, now to invest for my future grandchildren.

First written & revised Dec 2020; revised & updated Apr 2022.

References

- Bruton, E. “Diamond”, 1981, pp.17. NAG Press

- Rough Polished ”Prospects for World Diamond Mining Industry” https://www.rough-polished.com/en/analytics/111305.html

- Bloomberg - diamond market - https://www.bloomberg.com/news/articles/2019-03-27/the-great-diamond-shortage-that-never-was-is-likely-coming-soon

- De Beers Diamond Insights Report 2018 https://www.debeersgroup.com/reports/insights/the-diamond-insight-report-2018

- USGS – Synthetic Diamond https://minerals.usgs.gov/minerals/pubs/commodity/diamond/mcs-2017-diamo.pdf

- Rapaport Diamond Price Index https://www.diamonds.net/News/NewsItem.aspx?ArticleID=63521&ArticleTitle=Rapaport+TradeWire+March+28%2C+2019

- Mercury Diamond Price Index, Ehud Laniado https://www.ehudlaniado.com/home/index.php/news/entry/polished-diamond-price-index-sharp-price-changes-up-and-down

- MVI Marketing Millenial Consumer Research – Lab Grown Diamonds https://www.mvimarketing.com/download-report.php?report=34

- ABN AMRO - industry sentiment Https://insights.abnamro.nl/en/2019/01/diamond-sector-outlook-entering-a-growth-and-disruption-phase

- Mining MX - challenge to lower end jewellery https://www.miningmx.com/news/diamonds/35100-diamond-jewellery-sales-facing-never-seen-before-challenge-in-luxury-stakes/

- BBC report https://www.bbc.com/future/article/20200207-the-sparkling-rise-of-the-lab-grown-diamond

- Annual report by Bain & Antwerp World Diamond Producers: https://www.bain.com/insights/global-diamond-industry-report-2019/

Disclaimer

This article has been compiled by Jessica Cadzow-Collins from sources believed to be reliable, but no representation or warranty, express or implied, is made as to its accuracy, completeness or correctness. All opinions and estimates contained in this article are judgements as of the date of this article, are subject to change without notice and are provided in good faith but without legal responsibility. This article should not be construed as business advice and the insights are not to be used as the basis for investment or business decisions of any kind without your own research and validation. This article is for information purposes only.